Get the free dmv form mv3230

Show details

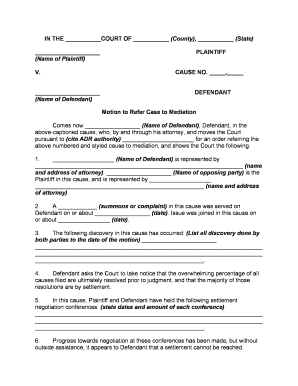

COMMERCIAL DRIVER CERTIFICATION TIER OF OPERATION Wisconsin Department of Transportation WisDOT MV3230 7/2015 Clear Form Print Federal and state regulations require all Commercial Driver License CDL holders to certify their tier of operation the type of operation in which they are engaged. Based on that certification some drivers will be required to provide a copy of their Federal Medical Examiner Certificate Fed Med card to the Wisconsin Division of Motor Vehicles WI DMV so the information...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

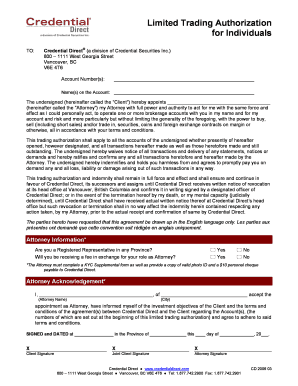

Edit your dmv form mv3230 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dmv form mv3230 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dmv form mv3230 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form mv 3230. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out dmv form mv3230

How to fill out form 3230?

01

Begin by obtaining a copy of form 3230. This can typically be found on the official website of the organization or agency that requires the form.

02

Carefully read the instructions provided with the form to ensure that you understand the purpose and requirements of form 3230.

03

Fill in your personal details in the designated sections of the form. This may include your name, address, contact information, and any other requested information.

04

If applicable, provide any additional information or documentation required to support your application or request. This could include identification documents, proof of residency, or any other relevant paperwork.

05

Double-check all the information you have entered to ensure accuracy. Any mistakes or missing information may cause delays or processing issues.

06

Sign and date the form as required. Make sure to comply with any additional instructions regarding signature placement or other specific requirements.

07

If necessary, make copies of the completed form for your records before submitting it to the appropriate recipient.

Who needs form 3230?

01

Form 3230 is typically required by individuals who need to submit specific information or documentation to an organization or agency.

02

It may be necessary for individuals applying for certain types of benefits, permits, licenses, or services to fill out form 3230.

03

The specific instances or situations in which form 3230 is needed will vary depending on the requirements of the organization or agency involved. It is important to consult the instructions or guidelines provided with the form to determine if it applies to your particular circumstances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 3230?

Form 3230 is a document used by the federal government to report certain financial information regarding federal contracts. It is specifically used to report the costs incurred by contractors on a job, both direct and indirect. This form helps track and monitor the cost associated with federal contracts, ensuring proper accountability and financial management.

Who is required to file form 3230?

Form 3230 is for individuals who are filing a claim for refund due to an overpayment of taxes. It is a form specifically for requesting the return of excess taxes paid.

How to fill out form 3230?

Form 3230 is a standardized form used by the United States Customs and Border Protection (CBP) to record the arrival of a vessel in a U.S. port. Here are the steps to fill out Form 3230:

1. Obtain a blank copy of Form 3230: You can download the form from the CBP website or request a copy from the CBP office.

2. Identify the arrival location: Provide the name of the port where the vessel is arriving in the "Port" field at the top of the form.

3. Enter vessel information: Fill in the vessel-related details in the fields provided. This includes the vessel's name, country of registration, official number, tonnage, and purpose of entry.

4. Provide voyage details: Specify the voyage number, estimated time of arrival, last foreign port, and the U.S. port from which the vessel departed in the respective fields.

5. Indicate type of entry: Mark whether the vessel's entry is for immediate transportation, unladen, or laden.

6. Report cargo information: List the types of cargo being transported in the appropriate fields. Include details such as the number of packages, weight, value, and marks (identification numbers, letters, or symbols).

7. Declare passenger information: If applicable, provide details about the number of passengers onboard, including crew, by nationality.

8. Include additional remarks: Any additional information or remarks related to the vessel's arrival or cargo can be entered at the bottom of the form.

9. Signature and date: The form must be signed by the master or an authorized representative of the vessel. Add the date of signature next to the signature.

10. Retain a copy: Make sure to keep a copy of the completed form for your records.

11. Submit the form: Submit the completed form to the appropriate CBP office upon arrival at the U.S. port.

It is essential to ensure the accuracy and completeness of the information provided on Form 3230. Falsifying information or failing to submit the form can result in penalties, delays, or other legal consequences.

What is the purpose of form 3230?

Form 3230 refers to the Cash Daily Report, which is used to record all cash transactions that occur within an organization on a daily basis. The purpose of this form is to maintain an accurate record of cash inflows and outflows, ensuring transparency and accountability in financial transactions. It is typically used by businesses to track cash sales, cash expenses, and the overall cash balance at the end of each day. This form helps in maintaining proper financial controls, reconciling cash, and detecting any discrepancies or errors in cash handling.

What information must be reported on form 3230?

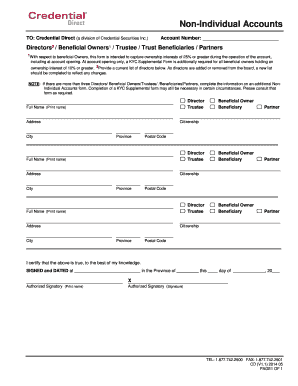

Form 3230 is used by businesses to report information about their assets and liabilities. The specific information that must be reported on this form includes:

1. Identification of the reporting entity: The name, address, and taxpayer identification number of the reporting entity must be provided.

2. General information: The form requires reporting of the date of the balance sheet, the currency used, and the reporting period covered.

3. Assets: The form requires a breakdown of the reporting entity's assets, including current assets (e.g., cash, accounts receivable, inventories), property and equipment, goodwill, and other assets.

4. Liabilities: The form requires a breakdown of the reporting entity's liabilities, including current liabilities (e.g., accounts payable, accrued expenses), long-term debt, and other liabilities.

5. Capital and reserves: The form requires reporting of the reporting entity's capital structure, including common and preferred stock, retained earnings, and other reserves.

6. Additional disclosures: The form may require additional disclosures based on specific accounting requirements or regulations.

It's worth noting that the specific information required on Form 3230 may vary depending on the reporting framework or regulatory environment applicable to the reporting entity.

What is the penalty for the late filing of form 3230?

The penalty for late filing of Form 3230 depends on the jurisdiction and the specific regulations in place. In general, late filing penalties may include monetary fines or interest charges. It is advisable to consult the relevant tax or government authorities or seek professional advice for accurate and specific information regarding late filing penalties for Form 3230 in a particular jurisdiction.

Can I create an electronic signature for the dmv form mv3230 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your form mv 3230.

How do I fill out the mv form 3230 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign form mv3230 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit mv 3230 form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like mv3230 form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your dmv form mv3230 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mv Form 3230 is not the form you're looking for?Search for another form here.

Keywords relevant to form 3230

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.